How To Develop A Digital Brand In The Financial Space

Building Trust in the Digital Age: A Comprehensive Guide to Developing a Strong Financial Services Brand

We know that running a business, especially in the financial sector, can feel overwhelming. As the leader of a bank, investment firm, or other financial institution, your focus is often on daily operations and regulatory compliance. But there’s an additional task that’s essential to your long-term success—building a digital brand that connects with both current and prospective clients. Trust is at the heart of the financial services industry, and developing a brand that fosters that trust is critical. It may seem daunting, but with the right strategy and creative team that truly understands your target audience—or "avatar"—you can create a digital brand that resonates. You need to know what your customers’ emotional triggers are, what colors and imagery appeal to them, and how to craft messaging that communicates reliability.

In this article, we’ll explore how to build a successful digital brand in the financial services space. From understanding your audience to leveraging personalized marketing and omnichannel strategies, these insights will help you attract and retain clients in today’s digital world.

1. Understand Your Audience’s Needs

Building a digital brand starts with understanding your target audience. Whether you’re managing a large financial institution or a fintech startup, your goal should be the same: to create a strong brand identity, showcase your values, build trust, and communicate effectively through digital marketing. This process begins with identifying your ideal customer or "avatar"—a detailed persona based on demographics, behaviors, and pain points. Once you understand your audience’s needs, you can craft messaging that speaks directly to their concerns.

For example, millennials may prioritize user-friendly mobile apps and transparency in fees, while Gen X clients might value long-term financial planning tools. High-net-worth individuals could be looking for personalized wealth management services. Knowing what your customers want allows you to tailor your digital branding and service offerings to meet their specific needs.

A Strategy& study found that brand identity has a significant positive impact on total shareholder return, emphasizing the importance of a well-defined brand strategy. In the financial services space, this is even more critical because trust and reliability are the foundation of customer relationships. When your brand consistently addresses your audience’s needs and offers solutions to their financial challenges, you create a strong foundation for long-term loyalty.

2. Craft a Compelling Brand Story

In an industry that can often feel impersonal or overly complex, storytelling is one of the most effective ways to humanize your brand. Your brand story should highlight the unique values, mission, and history that set your financial institution apart. Are you a fintech disruptor offering cutting-edge digital solutions? Or perhaps you’re a long-established institution with a history of stability and trustworthiness. Crafting a narrative that aligns with your audience’s values will make your brand more relatable and engaging.

For example, American Express has built its brand not just around its credit card services but around the idea of exclusivity, lifestyle, and experiences that come with being a cardholder. Similarly, your brand should evoke emotions—whether that’s security, innovation, or reliability—that resonate with your target audience.

3. Consistency Across Channels

Consistency is the cornerstone of building a successful brand. A cohesive logo, color scheme, design, and tone of voice are essential to establishing and maintaining a recognizable brand identity. In fact, it’s no surprise that a modern business’ success hinges on its brand—or lack thereof. Customers need to be able to recognize your brand no matter where they encounter it, whether that’s on your website, social media, or through digital ads.

Consistency isn’t just about visuals; it also extends to messaging. Your brand’s values and voice should be clear and aligned across all platforms. This consistency reassures potential clients that they can trust your institution because they see the same professionalism and values represented everywhere they interact with you.

As digital channels become more varied—from your website and social media to email and in-person interactions—maintaining this consistency is crucial. A unified brand presence builds credibility and fosters the kind of trust that is so essential in the financial services space.

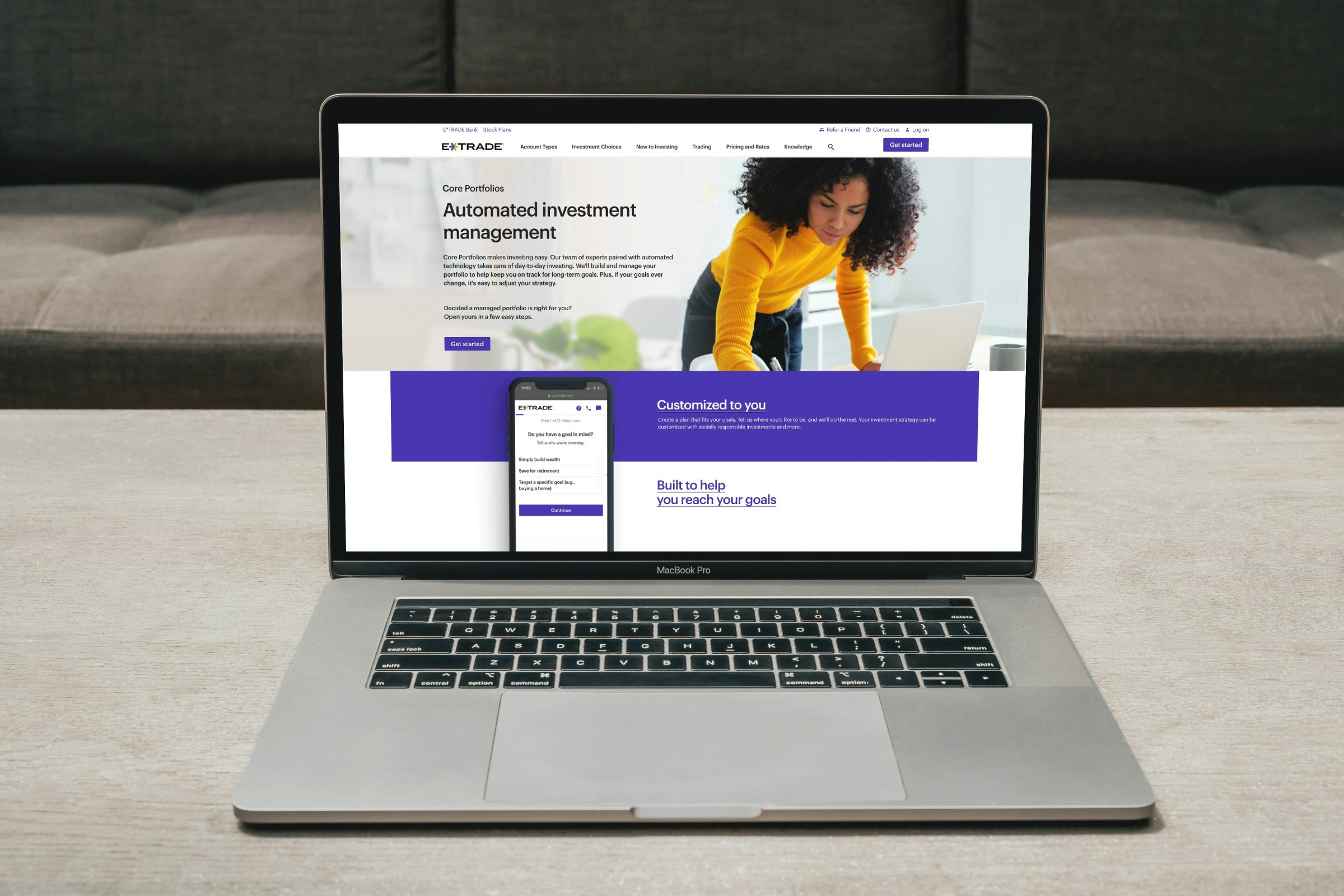

4. Personalized Customer Experiences

Personalization plays an outsized role in financial services branding. Many firms have seen their customer retention rates drop in recent years, partly because customers feel a lack of personal connection with the brand. To stand out in a crowded marketplace, financial firms need to offer personalized experiences that make clients feel valued and understood.

A great way to improve customer retention is through personalized services like tailored investment advice or product recommendations based on user data. By analyzing customer behavior and preferences, you can create a more customized experience that speaks directly to individual needs. According to Deloitte, 80% of customers expect personalized experiences from their financial services providers. Offering these kinds of hyper-focused interactions can increase client satisfaction and foster loyalty.

Whether you’re segmenting your audience by demographics or using predictive analytics to anticipate their needs, personalization will help you build stronger relationships with your clients.

5. Omnichannel Marketing for Seamless Engagement

An effective digital brand doesn’t just exist on one platform—it spans multiple channels in a cohesive, omnichannel strategy. This approach allows your brand to reach customers wherever they are, be it through email, social media, SMS, or your website. An omnichannel digital marketing strategy might include sending email newsletters to announce new services, sharing financial insights on LinkedIn or Twitter, and using paid search ads to drive traffic to your landing pages.

Each channel serves a different purpose but should work together to build a consistent brand message. For example, social media posts can drive engagement and increase awareness, while a well-designed mobile app can enhance the user experience by offering easy access to account management and financial advice.

Today’s customers expect frequent, seamless interactions with their financial service providers, and an omnichannel strategy helps ensure you meet these expectations. Consistency and personalization across these touchpoints reinforce your brand and keep you top-of-mind for clients.

6. Meeting Customers Where They Are

Technology has drastically changed how consumers interact with brands, especially in the financial services space. Today’s clients are more skeptical and informed, and younger generations have entirely different expectations than their parents did. For example, a GOBankingRates study found that 34% of Gen-Z are learning personal finance strategies through social platforms like TikTok and YouTube. To remain competitive, financial institutions must meet clients where they are—whether that’s on social media, through digital ads, or via mobile apps.

This shift presents a unique opportunity to connect with new audiences. By creating engaging content on the platforms your audience uses most, you can capture their attention and build trust in a space that feels more personal to them. For instance, a bank targeting younger audiences might create TikTok videos explaining basic financial literacy concepts, while a wealth management firm could share expert advice on LinkedIn for high-net-worth individuals.

7. Adapting to Change and Innovating

The financial services industry is continually evolving, driven by new technologies, changing regulations, and shifting customer expectations. To stay ahead of the competition, your digital brand must evolve as well. Regularly reassess your brand strategy, monitor market trends, and be willing to innovate. Whether that means adopting AI-powered customer service tools, integrating blockchain for secure transactions, or using data analytics to deliver personalized marketing, staying adaptable is key.

It’s important to remember that your digital brand is not static. As your audience’s needs change and the digital landscape evolves, your brand must grow and innovate accordingly. Firms that are slow to adapt risk falling behind as clients gravitate toward more modern, forward-thinking alternatives.

Conclusion

The financial services industry is more competitive than ever, and building a strong digital brand is essential for standing out in the crowded marketplace. Whether you’re working for a large firm or a small startup, your goal is to create a brand that resonates with your audience, fosters trust, and adapts to the changing digital landscape.

By understanding your audience, crafting a compelling brand story, ensuring consistency across channels, and leveraging personalized experiences and omnichannel marketing, you can create a digital brand that not only attracts clients but retains them over the long term. In a sector where trust is everything, your digital brand can make all the difference in how clients view and engage with your institution.

Make Your Business Online By The Best No—Code & No—Plugin Solution In The Market.

30 Day Money-Back Guarantee

Say goodbye to your low online sales rate!

1. Why is building a digital brand important for financial services companies?

Building a digital brand is crucial because the financial services industry relies heavily on trust and long-term relationships with clients. In today’s digital landscape, potential customers often start their research online, and a well-crafted digital brand can help establish credibility, showcase your company’s values, and foster trust. It also allows you to differentiate yourself in a highly competitive market and connect with your audience on a deeper level.

2. What are the key elements of a successful digital brand for financial institutions?

A successful digital brand in the financial services space requires a clear understanding of the target audience and their specific financial needs, along with a consistent visual identity—such as logo, color scheme, and typography—across all digital platforms. It should also have a compelling brand story that humanizes the institution and fosters emotional connections with clients. Additionally, personalized experiences tailored to different customer segments are essential, as is an omnichannel presence that ensures seamless engagement across various platforms like websites, social media, mobile apps, and email.

3. How can financial services companies personalize customer experiences?

Financial institutions can personalize customer experiences by using data analytics to better understand the needs, preferences, and behaviors of different customer segments. Personalized services could include customized investment advice, tailored financial products, and content that addresses specific financial concerns. Additionally, by segmenting your audience based on demographics and behavior, you can provide more relevant messaging and offers.

4. What is omnichannel marketing, and why is it important in the financial services industry?

Omnichannel marketing refers to a strategy where a brand’s messaging, services, and customer experience are consistent across all digital channels—be it through social media, email, website, SMS, or mobile apps. For financial services companies, omnichannel marketing ensures that clients can seamlessly interact with your brand, regardless of the platform they use. This approach helps maintain a cohesive brand identity and enhances customer engagement and satisfaction.

5. How does UX design, especially for login and logout, impact a financial services brand?

UX design plays a crucial role in shaping how clients perceive and interact with your financial services brand, especially during critical touchpoints like logging in and out of mobile apps or websites. A smooth, user-friendly design enhances convenience and fosters a positive emotional connection. The use of professional, calming color schemes (like blue for stability) and clean layouts can make clients feel secure and confident. Simple, secure login processes, personalized dashboards, and thoughtful design elements like welcoming messages all contribute to a seamless experience that strengthens client trust and satisfaction with your brand.